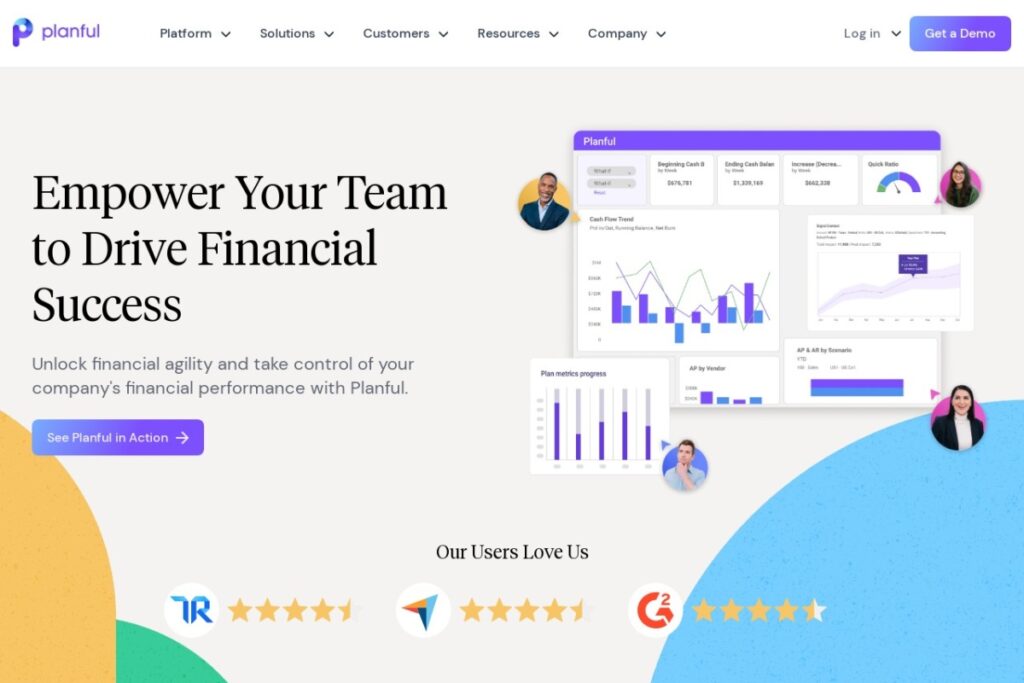

Planful is a cloud-based financial management platform that centralizes budgeting, forecasting, reporting, and analysis for medium to large organizations. The software combines essential financial tools with collaboration features, helping finance teams create accurate budgets, run predictive scenarios, and generate detailed reports while maintaining data accuracy across departments.

Finance professionals, accounting teams, and department managers use Planful to streamline their financial workflows and decision-making processes. The platform connects with existing business tools like Salesforce and QuickBooks, bringing financial data into one accessible location while automating many manual tasks that typically slow down financial operations.

Organizations choose Planful when they need to improve their financial planning accuracy, speed up their month-end close process, or create more detailed financial forecasts. Its modeling capabilities let teams test different financial scenarios, while its reporting tools generate clear visualizations that help communicate financial data to stakeholders. The platform’s automation features reduce errors and free up time for strategic financial planning.